The experience economy leads the growth of the audiovisual sector

The IOTA study 2024, carried out by Avixa, highlights that the global revenues of the audiovisual integration industry will reach 422.000 millions of dollars in 2029. La economía de las experiencias, con soluciones tecnológicas para eventos en directo y los recintos, es el principal motor de esta industria.

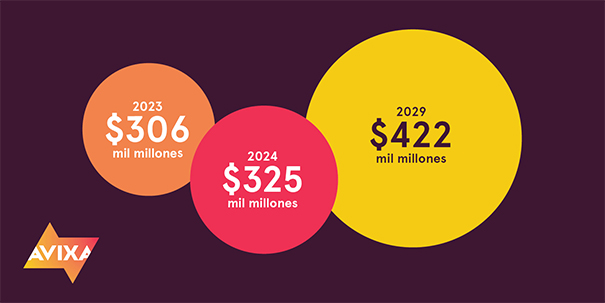

La industria de la integración de experiencias audiovisuales incrementará sus ingresos globales y pasará de 306.400 millones de dólares obtenidos en 2023 a alcanzar una cifra de 325.000 millones de dólares al cierre del 2024.

Aunque se trata de una tasa de crecimiento del 6,1%, es inferior al 6,9% del año anterior, según se prevé en el reporte Industry Outlook and Trends Analysis 2024 (IOTA) carried out by Avixa (Audiovisual and Integrated Experience Association).

De acuerdo a este análisis de tendencias y perspectivas, en los próximos cinco años, el mercado de la integración audiovisual sumará ingresos por 98.000 million dollars, con una tasa de crecimiento anual compuesto (CAGR) of the 5,35%, por lo que el pronóstico para 2029 is from 422 mil millones de dólares de ingresos globales.

Un primer dato revelador del reporte IOTA indica que mientras el proceso de transformación y actualización tecnológica de las oficinas sigue en marcha, el sector que lidera el crecimiento del sector audiovisual es la llamada economía de las experiencias.

El reporte IOTA 2024 de Avixa ofrece datos y análisis sobre el tamaño de la industria de la integración audiovisual desde una perspectiva global, además de desgloses regionales y verticales. La investigación abarca tendencias de productos, categorías de soluciones y mercados verticales.

“Los factores del crecimiento han variado mucho en el amplio panorama del sector de la integración audiovisual. Las tecnologías para integrar soluciones de conferencia y colaboración dentro de las empresas no se están desplazando tan bien como las soluciones que demandan los sectores del entretenimiento y los eventos en directo. Las empresas que se enfocan únicamente en la integración de sistemas audiovisuales de colaboración puede que no les vaya tan bien como a las que se dedican a las soluciones para entretenimiento”, states Sean Wargo, vicepresidente de Market Insight de Avixa.

Motores del mercado

Antes de la pandemia, la economía de las experiencias era una de las tendencias más influyentes, y hoy ha recuperado su posición. Of 2024 al 2029, los ingresos globales provenientes de las soluciones audiovisuales para recintos y eventos crecerán hasta los 57.200 million dollars, con una CAGR del 6,3%, lo que lo convierte en el mercado vertical de más rápido crecimiento.

Todo lo relacionado con el entretenimiento presencial crece rápidamente. Esto incluye la captura y producción de contenidos y las transmisiones vía streaming, también conocido como broadcast AV.

El futuro de la oficina corporativa sigue siendo un negocio seguro. Al ser el mayor mercado vertical para la industria de la integración audiovisual, el destino de las oficinas también representó una fuente de ansiedad durante la pandemia. However, a medida que las tendencias evolucionan hacia el trabajo híbrido, esas preocupaciones han disminuido, abriendo nuevas posibilidades de mercado y renovando la confianza en este sector.

Los espacios corporativos generarán ingresos globales por 91.400 millions of dollars in 2029, impulsados por nuevas construcciones, más oportunidades en soluciones de conferencias y colaboración, el auge de la captura y producción de contenidos, así como las soluciones de seguridad, vigilancia y protección vital. Nevertheless, se espera que el crecimiento en este sector disminuya un poco menos del 5% en los próximos cinco años.

Crecimiento mundial

La región de Asia-Pacífico sigue presentando un sólido crecimiento en la integración audiovisual, a pesar de un descenso del 7,3% al 6,9% of 2023 a 2024, debido en gran parte a la desaceleración de la tasa de crecimiento de China. Dentro de la región, India se coloca a la cabeza como el mercado de integración audiovisual de más rápido crecimiento, aunque China se mantiene como el de mayores ingresos.

En la región de Asia-Pacífico, los eventos en directo y las soluciones de seguridad, vigilancia y protección vital muestran fuertes tasas de crecimiento del 10, 8% and the 8,3%, respectively.

Encabezado por el mercado de Norteamérica (Canadá y EE.UU.) con una proyección de ingresos de 104.000 millions of dollars in 2024, la industria de integración audiovisual en el continente americano se percibe como un mercado maduro que saca partido de la innovación para sostener el crecimiento, además de ofrecer un efecto estabilizador en la infraestructura digital, particularmente en Latinoamérica. La región en su conjunto está experimentando un aumento de los ingresos en la integración audiovisual en recintos y eventos, con un crecimiento del 8,5% en Norteamérica y del 10,2% en Latinoamérica.

En la región de EMEA (Europa, Oriente Medio y África), el mercado de 86.400 millones de dólares se ve reforzado por la madurez de los mercados europeos con inversiones estratégicas constantes y los prometedores mercados en desarrollo en Oriente Medio, donde los países del Consejo de Cooperación para los Estados Árabes del Golfo (GCC) viven un notable crecimiento. Los sectores de integración audiovisual de mayor crecimiento en la región son los de eventos en directo, espectáculos y entretenimiento, y seguridad.

Retos del mercado

A escala mundial, los retos del mercado de la integración audiovisual experimentan el tránsito de los problemas de la cadena de suministro a las limitaciones de mano de obra, en niveles similares a los de antes de la pandemia. Los aumentos salariales demuestran que el mercado laboral sigue muy ajustado y que más trabajadores conservan sus empleos a un coste mayor para las empresas.

El impacto de la artificial intelligence (IA) es notable. La IA reconfigurará el sector de la integración audiovisual con aportes a la automatización inteligente en los sistemas de seguridad, vigilancia y protección; incorporando interfaces adaptables a los sistemas de mando y control; y mejorando las experiencias que ofrecen las soluciones de conferencia y colaboración.

Did you like this article?

Subscribe to our NEWSLETTER and you won't miss anything.