Avixa foresees growth in the AV integration sector of the 3,9% in 2030

Forecasts on global revenue of the audiovisual integration industry are estimated at 402.000 millions of dollars in 2030, according to new IOTA report 2025 of Avixa.

The Experience economy and hybrid work drive growth en la industria AV, that appears resilient despite the market slowdown. The new report Industry Outlook and Trends Analysis 2025 (IOTA 2025) of the association Avixa foresees that the global AV integration industry revenue will grow from 332.000 million dollars expected at the end of this year 402.000 millions in 2030.

This forecast of increase of 70.000 million dollars in the next five years It is an example of the resilience of the sector, Although the income of 2024 were below the figure forecast in the previous report.

The IOTA report is a comprehensive analysis of the audiovisual integration market, that uses data from the last five years and contributions from various market players. By providing an overview of end-user spending, provides data on the size of this industry with a global perspective, segmented by geographic zones, vertical markets, solution areas and product categories.

In the previous report, the growth projection for the next five years it was 5,3%, but Avixa has adjusted it to 3,9%, based on the opinion of sector experts and taking into account the current macroeconomic climate.

Although the uncertainty generated by the imposition of tariffs, geopolitics and high interest rates have a decelerating effect, The audiovisual sector is expected to exceed the global GDP growth in 0,8 percentage points.

As pointed out Sean Wargo, vp. of market insight at Avixa and head of the team in charge of the IOTA report (in the right image): “los datos apuntan a que el sector de la integración AV sigue bien posicionado para el éxito a largo plazo, even in a more cautious growth environment. Strategic investment in emerging technologies, “Regional diversification and collaborations between sectors will be essential to take advantage of more opportunities in the future”.

As pointed out Sean Wargo, vp. of market insight at Avixa and head of the team in charge of the IOTA report (in the right image): “los datos apuntan a que el sector de la integración AV sigue bien posicionado para el éxito a largo plazo, even in a more cautious growth environment. Strategic investment in emerging technologies, “Regional diversification and collaborations between sectors will be essential to take advantage of more opportunities in the future”.

Although the sector continues to exceed world GDP, Wargo points out that “the pace of expansion has slowed down; a reflection of the post-pandemic recovery's shift toward more stable, experience-driven markets, like in-person events, retail trade, venues for shows and hospitality”.

Specifically, The hybrid workspace model and the experience economy are the two factors that shape and drive demand in this industry, according to the report.

By investing in AV technology to improve engagement and collaboration in and out of the office, Companies are fostering an increasingly close link between the tools and actions that transform the workplace by leveraging entertainment-based experiences.

Worldwide, India has taken the leadership that China held in recent years, becoming the most prominent country in the Asia-Pacific region (APAC), which continues to be the engine of growth in the AV sector.

Its rise has been driven by increased infrastructure investment and the growing need for immersive, technology-based experiences.. Other regions experiencing high growth are the Middle East and Latin America.

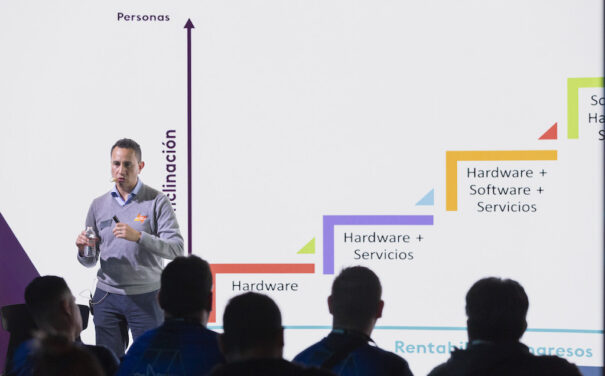

For Sergio Gaitán Serrano, Avixa regional manager for Mexico and northern Central America (in the attached image), “Latin America reflects most global trends with one key difference: Services are the main source of income in the professional audio and video sector. This underlines the importance of knowledge as a professional tool, an area with considerable growth potential, where certifications represent a significant differentiator”.

For Sergio Gaitán Serrano, Avixa regional manager for Mexico and northern Central America (in the attached image), “Latin America reflects most global trends with one key difference: Services are the main source of income in the professional audio and video sector. This underlines the importance of knowledge as a professional tool, an area with considerable growth potential, where certifications represent a significant differentiator”.

According to the report, This industry evolves thanks to the search to deliver new forms of audiovisual experiences, among which four key technologies stand out:

OFF over IP, which is already a common element of audiovisual installations, allows content distribution and system control over IP networks. Market driving factors are operational efficiency, cost reduction and immersive experiences.

Use of software and the cloud, increasingly important for audiovisual operations, as they allow remote management and scalability.

Artificial intelligence, a technology that is enhancing the capacity of systems, assisting in areas such as design, scheduling and optimizing people's time and work.

Extended reality (XR), gaining momentum in sectors such as entertainment, retail sales and education.

The rise of these four technologies results in greater demand for related products, among which hardware and services for content management predominate.

standalone software, especially AI-based tools, It is the fastest growing category. This trend highlights a broader shift towards value-added services and smart infrastructure.

The IOTA report 2025 Avixa also allows us to identify patterns that demonstrate resilience in the face of recession. For example, the business environment remains the largest segment of buyers, even though its growth has slowed. In contrast, among the sectors experiencing an acceleration are the government, the military, energy and public services.

Regarding solutions, technology for conferences and collaboration continues to be the most in demand, although security and surveillance systems are rapidly rising in investment priorities.

Another solution with sustained growth is the production and dissemination of audiovisual content.. In fact, investment in these technologies already occupies second place, only behind those used for conferences and collaboration.

More and more companies understand that their messages and corporate events can be a source of valuable content, ready to capture and share, with a growing interest in developing audiovisual content creation capabilities, from pieces for social networks or podcasts to their own dissemination platforms, with the advantage that the audience can interact.

Did you like this article?

Subscribe to our NEWSLETTER and you won't miss anything.