Omnichannel technologies revolutionize the way banks communicate with their customers

Beabloo explica en este artículo los beneficios que aporta la tecnología de digital signage a las entidades financieras, permitiendo optimizar y crear valor en las comunicaciones con sus clientes y obtener ventajas competitivas.

La irrupción de las tecnologías omnicanal ha revolucionado la forma en que muchos bancos se comunican con sus clientes. According to Beabloo, entre otras ventajas, estas soluciones, que trasladan al mundo offline la facilidad de análisis de resultados del entorno digital, proporcionan a las oficinas bancarias datos de gran valor para conocer mejor a sus clientes, comprobar la eficacia de sus estrategias de marketing, incrementar el ROI y, above all, crear experiencias únicas para los consumidores.

La omnicanalidad se ha confirmado como una necesidad en el sector bancario. Según datos de la última Global Consumer Banking Survey de EY, he 44% de los consumidores asegura que no confiaría en un banco sin oficinas y un 66% considera muy importante que la entidad cuente con presencia online. A pesar del auge que ha experimentado la comunicación digital, el mundo online no puede considerarse un sustituto del offline, sino que ambos canales deben alinearse y complementarse para ofrecer una experiencia cohesionada y enriquecida al consumidor.

La brecha entre los bancos que se ocupan de mejorar la experiencia del cliente y los que no es cada vez mayor y la tecnología es clave para que las entidades bancarias puedan optimizar y crear valor en las comunicaciones con sus clientes y obtener ventajas competitivas.

Ventajas de la analítica offline para bancos

Con los sistemas de analítica offline es posible fijar indicadores clave de rendimiento y conocer la efectividad de campañas de comunicación a partir de datos medibles.

Mediante la instalación de equipos de análisis offline como dispositivos WiFi y video analytics (y tras combinar e interpretar los datos obtenidos por ambas vías), los bancos pueden conocer la conducta y los perfiles de sus clientes y ajustar sus campañas publicitarias.

Algunas métricas de interés para los bancos son el número de visitas y recurrencia, el ratio de entrada, el tiempo de permanencia en oficina, las diferencias de afluencia entre franjas horarias, los hábitos de los distintos segmentos de edad, el porcentaje y perfil de clientes que van a caja y de clientes que usan el cajero y los clientes que acuden a más de una oficina de la entidad.

Con una monitorización de estas métricas, es posible observar la incidencia de cualquier cambio en la estrategia de comunicación del banco, y reajustar a tiempo alguna acción que no esté funcionando de la forma esperada.

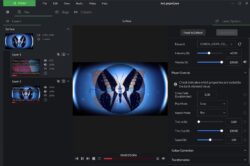

El digital signage en oficinas bancarias

Por su versatilidad y agilidad para renovar mensajes, la cartelería digital es una óptima para el sector bancario. In fact, he 60% de las instituciones financieras ya lo aplican para impulsar su brand awareness, publicitar sus productos, diferenciarse de la competencia y promover una comunicación cohesionada en todos sus canales.

Besides, he 95% de estas entidades afirma estar satisfecha con la implementación de las pantallas digitales, una acción que se traduce en un importante ahorro en el lanzamiento y distribución de material promocional en toda la red de agencias.

Si esta tecnología se equipa con un sistema de vídeo analytics, los responsables de cada sucursal pueden conocer cómo reaccionan los clientes ante cada campaña: ¿cuántas personas ven un anuncio?, ¿qué contenidos son más atractivos?, ¿cómo funcionan con cada segmento demográfico?

La agilidad de este sistema permite actualizar los mensajes con facilidad, at all times (incluso de forma remota) y ajustarlos al segmento objetivo. For example, si la analítica muestra que entre las 10 and the 12 de la mañana, he 80% de clientes de una oficina son de un perfil determinado, es buena idea que los contenidos emitidos vía digital signage durante esa franja horaria se ajusten al lenguaje y necesidades de ese segmento.

In addition, existen dispositivos de digital signage con software de detección facial que ofrecen una experiencia absolutamente personalizada y atractiva en el punto de venta, y que dotan la oficina de un look & feel innovador y puntero. Estas pantallas proyectan un mensaje u otro en función de la edad y el género de la persona que se encuentre delante del monitor.

App propia y beacons

Para las entidades bancarias, una aplicación móvil constituye una buena herramienta para comunicarse con los clientes, incrementar su fidelidad y explorar nuevas formas de mejorar la experiencia de los consumidores.

Si el desarrollo de una app propia se complementa con la instalación de beacons, los bancos pueden proyectar contenidos dinámicos y personalizados (como mensajes de bienvenida o información sobre productos relevantes) en las pantallas de digital signage repartidas por la oficina, acompañando a los clientes durante toda su estancia. In addition, si el consumidor lo autoriza, también es posible enviar notificaciones a su smartphone.

Estos dispositivos aportan información sobre las preferencias del cliente a la hora de moverse por la entidad (muy importante para detectar las zonas más transitadas y obtener el mayor rendimiento del espacio), y pueden proporcionar información al personal de la oficina que puede optimizar su jornada laboral, anticiparse a las demandas y necesidades del cliente y ofrecer un trato VIP.

Experiencia 360º con encuestas de satisfacción

Un cliente debe sentirse bien atendido desde que pone un pie en la oficina hasta que se marcha. Una tecnología que ofrece al consumidor una experiencia inolvidable e integral son las encuestas de satisfacción, que no solo proporcionan feedback a los responsables de la entidad bancaria, sino que demuestran a los clientes que su opinión es importante y se tiene muy en cuenta.

Así pues, una forma de poner un broche de oro a la experiencia en el punto de venta es colocar una tablet a la salida del establecimiento, con un mensaje que anime a los clientes a expresar su grado de satisfacción. Una opción sencilla y muy visual de hacerlo es ofreciendo la posibilidad de pulsar sobre el dibujo de una cara triste, neutra o feliz.

Did you like this article?

Subscribe to our NEWSLETTER and you won't miss anything.